Bitcoin mining difficulty drops 6% in largest fall since bear market lows

Quick Take

- Bitcoin mining difficulty has dropped 5.7% to 83.1 trillion as the network’s hash rate falls below 600 EH/s following the halving.

- This latest difficulty adjustment is the largest drop since December 2022, when bitcoin was trading for around $17,000.

Bitcoin  BTC

-0.47%

mining difficulty dropped 5.7% on Thursday in the largest negative adjustment for nearly 18 months.

BTC

-0.47%

mining difficulty dropped 5.7% on Thursday in the largest negative adjustment for nearly 18 months.

The difficulty adjustment came at block height 842,688, falling to 83.1 trillion, according to Bitbo data. It marks the highest negative adjustment since the bear market lows, when difficulty fell 7% on Dec. 6, 2022, and bitcoin was trading for around $17,000.

Bitcoin mining difficulty is a relative measure of how hard it is to mine a new block compared to the easiest it can ever be. It adjusts automatically every 2016 blocks — roughly two weeks — to ensure that, on average, a new block is found every 10 minutes, regardless of how many miners are actively mining.

When there’s an increase in the number of miners, the difficulty of mining bitcoin rises. Conversely, if there is a decrease in the number of miners competing to find new blocks, the protocol lowers the mining difficulty, making it easier for the remaining miners to discover blocks.

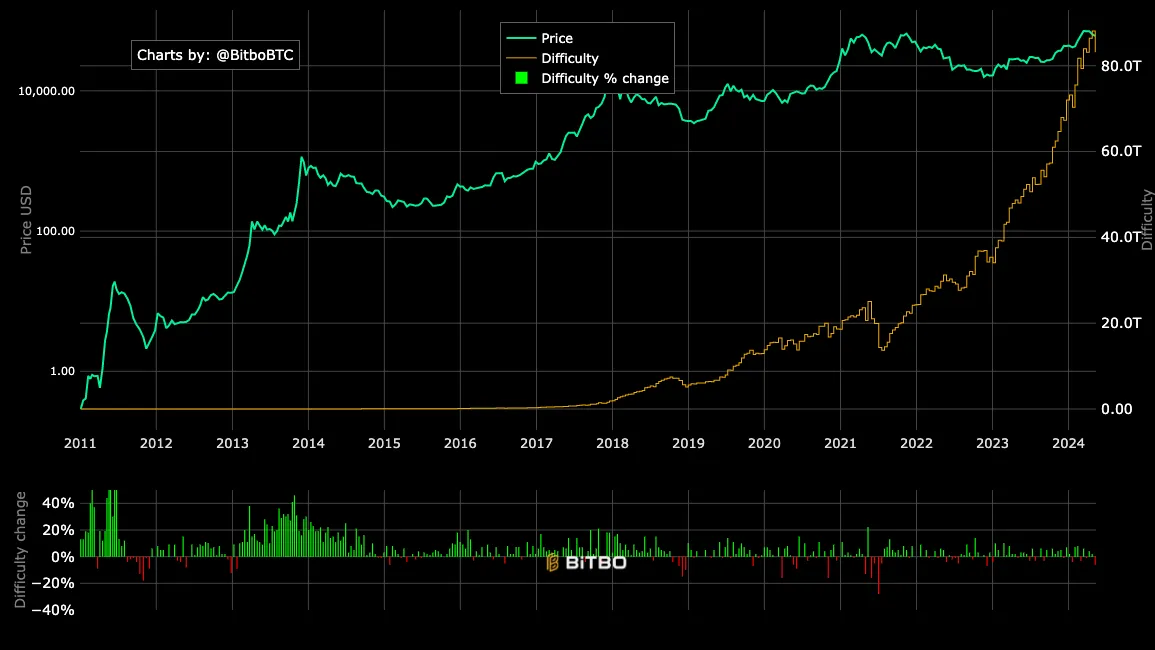

Bitcoin mining difficulty. Image: Bitbo.

The negative difficulty adjustment follows a 10% drop in network hash rate since the last difficulty adjustment on April 24, from a seven-day moving average of 639.58 EH/s to 578.74 EH/s as of yesterday, according to The Block’s data dashboard. Prior to the adjustment, average block times were running at 10 minutes and 36 seconds.

The drop in hash rate saw Bitcoin’s hash price slide to an all-time low of less than $50 per PH/s per day ($0.05 per TH/s per day) on April 29, as bitcoin’s price also fell back below the $63,000 level. Bitcoin is currently trading for around $61,000, according to The Block’s price page.

Hash price is a term coined by Bitcoin mining services firm Luxor, referring to the expected value of 1 PH/s or 1 TH/s of hashing power per day. The metric quantifies how much a miner can expect to earn from a specific quantity of hash rate.

However, today’s negative difficulty adjustment could help to ease some miners’ post-halving struggles, making it slightly easier to mine blocks than it has been for the past two weeks.

Bitcoin's difficulty falls after consecutive rises surrounding halving activity

Today’s negative Bitcoin mining difficulty adjustment is the first since a 1% drop at the end of March and follows two positive adjustments surrounding the halving.

Bitcoin’s fourth halving event occurred on April 20, with the final difficulty adjustment pre-halving and the first post-halving rising 4% and 2%, respectively, to a record 88.1 trillion, bookending a hash rate peak of 650.29 EH/s on April 19. The network’s hash rate has fallen around 11% since the halving.

The final pre-halving adjustment rise came as Bitcoin miners appeared to be ramping up their hash rate in preparation for block subsidy rewards dropping from 6.25 BTC to 3.125 BTC.

The initial post-halving difficulty adjustment increase — the first ever immediately following a halving event — was attributed to the hype surrounding Runes. Runes is a new fungible token standard for Bitcoin launched at the halving that initially helped to drive up transaction fee revenue for miners after the subsidy drop.

After halving block 840,000 generated $2.4 million in fees — far exceeding the approximate $200,000 worth of block subsidy reward — bitcoin went on a record 104-block run of transaction fee rewards higher than the subsidy, according to the Bitcoin explorer Mempool.

The Runes protocol was developed by Ordinals creator Casey Rodarmor, offering a more efficient solution for “etching” (creating) tokens on Bitcoin compared to BRC-20 tokens that use Ordinals inscriptions.

Runes transactions generated more than $135 million in fees in the first week following the launch. However, following the initial hype, average transaction fees dropped considerably from a record high of $128.45 on the day of halving to around $1, according to Mempool data.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.