Marathon Digital expands into altcoin mining to diversify revenue streams post-Bitcoin halving

Quick Take

- Marathon Digital has expanded into altcoin mining to diversify its revenue streams amid Bitcoin’s latest halving.

- Marathon said it deployed its first Kaspa miner in September and has since mined 93 million KAS worth around $15 million.

Marathon Digital, the largest public Bitcoin  BTC

+0.20%

miner by market cap, announced late Wednesday it had expanded into altcoin mining to diversify its revenue streams following Bitcoin's latest halving event.

BTC

+0.20%

miner by market cap, announced late Wednesday it had expanded into altcoin mining to diversify its revenue streams following Bitcoin's latest halving event.

The altcoin in question is Kaspa (![]() KAS

+6.55%

), with Marathon deploying its first Kaspa application-specific integrated circuit (ASIC) miners in September 2023. In total, Marathon said it has purchased around 60 PH/s of Antminer KS3, KS5 and KS5 Pro ASICs from manufacturer Bitmain, each of which it claims can generate up to 95% profit margins given the current network difficulty rate and price of KAS.

KAS

+6.55%

), with Marathon deploying its first Kaspa application-specific integrated circuit (ASIC) miners in September 2023. In total, Marathon said it has purchased around 60 PH/s of Antminer KS3, KS5 and KS5 Pro ASICs from manufacturer Bitmain, each of which it claims can generate up to 95% profit margins given the current network difficulty rate and price of KAS.

Half of its Kaspa hashrate is currently operational at the company’s facilities in Texas, with the remainder expected to go live in Q3. As of June 25, Marathon said it has mined 93 million KAS worth around $15 million.

In contrast, Marathon mined $176 million of Bitcoin in Q1 this year. It holds 17,857 BTC ($1.1 billion) as of May 31, according to the firm.

Marathon boasts the largest public miner holdings and second-largest corporate holding overall behind MicroStrategy’s 226,331 BTC ($13.8 billion), per Bitcoin Treasuries data.

What is Kaspa?

The relatively unknown Kaspa is currently the fifth-largest proof-of-work cryptocurrency behind bitcoin, dogecoin, bitcoin cash and litecoin, according to CoinGecko data. It has a market cap of $4.2 billion and a 24-hour trading volume of $128 million, according to The Block’s Kaspa price page. Kaspa’s circulating supply is approximately 24 billion KAS, with a current block reward of 103.83 KAS and a total supply of 28.7 billion KAS, according to Marathon.

While Kaspa also uses a proof-of-work consensus mechanism, it differs from Bitcoin in employing a BlockDAG (Directed Acyclic Graph), enabling multiple blocks to be produced simultaneously. Kaspa processes one block every second compared to an average of one every 10 minutes for Bitcoin, potentially allowing Kaspa miners to earn more block rewards in a given timeframe, Marathon said.

“By mining Kaspa, we are able to create a stream of revenue that is diversified from Bitcoin, and that is directly tied to our core competencies in digital asset compute,” Marathon Chief Growth Officer Adam Swick said in a statement.

RELATED INDICES

“Because of our existing infrastructure, our unique relationships with hardware manufacturers, our strong balance sheet, and the expertise of our team, Marathon was uniquely positioned to mine Kaspa and to capitalize on the higher margins that exist for those who can deploy Kaspa ASICs today,” Swick added. “We look forward to continuing to support innovation in proof-of-work ecosystems.”

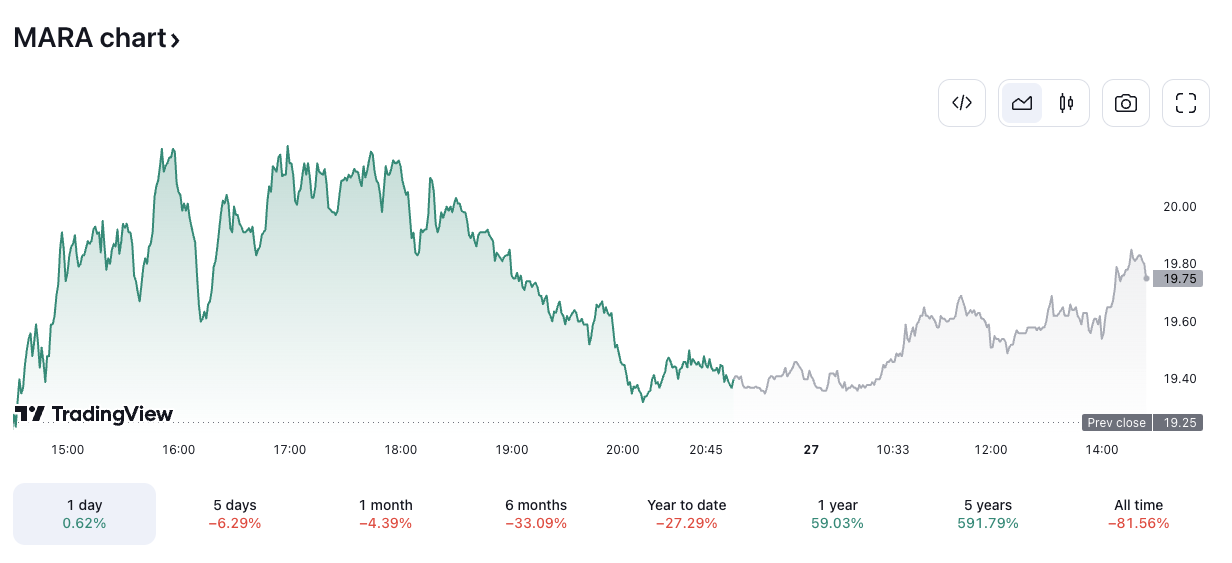

Marathon’s stock closed up 0.6% at $19.37 on Wednesday just as the announcement was made and is currently trading up 2% at $19.75 in pre-market trading. Its share price is down 27% year-to-date, according to TradingView.

MARA/USD price chart. Image: The Block/TradingView.

Bitcoin mining post-halving

Bitcoin’s fourth halving occurred on April 20, reducing miners’ block subsidy rewards from 6.25 BTC to 3.125 BTC, impacting revenues and profit margins.

Bitcoin halvings are programmed to occur automatically every 210,000 blocks — roughly every four years. Once a halving event occurs, miners receive 50% fewer bitcoins as a subsidy reward for every block of transactions they mine and add to the blockchain. However, they continue to earn additional transaction fee rewards for each block mined as usual.

The latest halving means that, on average, miners now produce around 450 new bitcoins collectively per day compared to 900 bitcoins previously.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.