Bernstein analysts highlight crypto's role in making election markets more efficient

Quick Take

- According to Bernstein, Crypto platforms like Polymarket are making election markets more efficient as the U.S. gears up to vote for its next president in November.

- Crypto policy has become an increasingly important political issue in recent months, with Donald Trump seeking to be viewed as the “pro-crypto” candidate.

While crypto policy has become an important issue amid the U.S. presidential campaign in recent months, blockchain-based platforms like Polymarket are making election markets more efficient, according to analysts at research and brokerage firm Bernstein in a note to clients on Monday.

Polymarket is the world’s largest and most popular blockchain-based decentralized prediction market, operating on the Ethereum Layer 2 network Polygon. Polymarket lets users speculate on various events, such as political outcomes, entertainment and sports, using the stablecoin USDC.

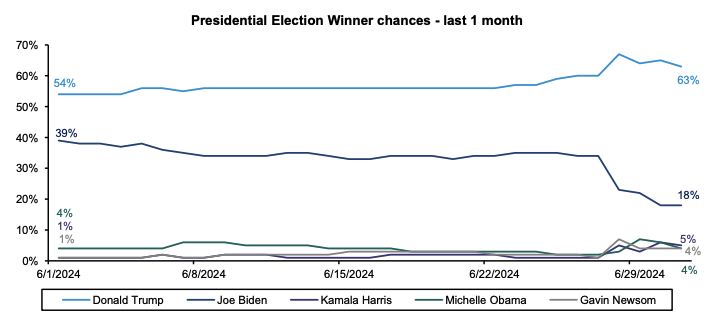

“Who will win the U.S. presidential election in 2024?” has attracted the most liquidity, with $205.5 million in bets so far, the analysts noted. Donald Trump is leading that market with a 63% chance — meaning users can buy one Trump share for 63 cents and would collect $1 if he wins. That compares to an 18% chance for Joe Biden as things stand.

“The value for a Biden share has dramatically declined by more than 50% from 39 cents just a month back to 18 cents today. Kamala Harris and Michelle Obama are the next biggest markets with 5 cents and 4 cents, signifying a 5% and 4% chance respectively,” Chhugani and Sapra said.

-

Presidential election winner chances. Image: Bernstein.

The second-largest pool is “Who will be the Democratic nominee for President?” with $71 million in bets. The leading contenders are Joe Biden, Kamala Harris, Michelle Obama and Gavin Newsom, with chances of 67%, 12%, 9% and 6%.

“The big moves have occurred recently post the recent presidential debate on June 27 — particularly in the Harris and Obama pools, with chances for Harris improving from 2% to 12% and chances for Michelle Obama improving from 6% to 9%,” the analysts said.

The third-largest pool is “Who will win the Republican VP nominee?” with $56 million in wagers. The leading contenders are Ben Carson (13%), J D Vance (12%), and crypto advocate Vivek Ramaswamy (9%).

RELATED INDICES

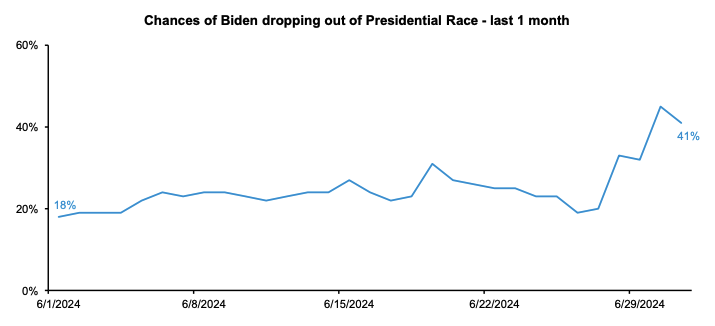

Finally, “Will Biden drop out of the Presidential race?” is the fourth-largest pool, attracting $8.8 million in bets so far. “The 'Yes' chances are 41%, which dramatically shot up from 20% chances post the June 27 debate,” Chhugani and Sapra wrote.

-

Chances of Biden dropping out of the presidential race. Image: Bernstein.

Crypto policy heats up as U.S. election issue

Former President Donald Trump, the presumptive Republican presidential nominee, was previously critical of Bitcoin and crypto. However, hosting an event on May 8 for people who bought his Trump “Mugshot” NFTs, he went on record as supporting crypto, accepting it for campaign donations and labeling Democrats such as Senator Elizabeth Warren and the Biden administration as “anti-crypto.”

Sources subsequently told The Block they noticed a significant “shift” in tone from the Biden administration and campaign toward crypto, with a new willingness to understand digital assets and their communities.

Pro-crypto donors have also been mobilizing, capturing the attention of political candidates on both sides of the aisle. Crypto-backed super PACs had raised a $100 million war chest by May, according to consumer rights advocacy group Public Citizen. Coinbase donated a further $25 million to crypto super PAC Fairshake in June.

Last week, the Bernstein analysts said crypto would become the primary “Trump trade” if election sentiment shifted more Republican.

In May, Polymarket announced it had raised $45 million from Peter Thiel’s Founders Fund, Vitalik Buterin and others.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.