Bitfinex report notes renewed profit realization by long-term bitcoin holders

Quick Take

- Bitfinex analysts noted in a report that long-term bitcoin holders are realizing profits again.

- The analysts said more long-term holder profit taking could exert significant near-term downward pressure on bitcoin’s price.

Bitcoin  BTC

-3.87%

long-term holders, who had paused profit-taking since early May, appear to have begun selling off their holdings again, according to Bitfinex analysts.

BTC

-3.87%

long-term holders, who had paused profit-taking since early May, appear to have begun selling off their holdings again, according to Bitfinex analysts.

"Long-term holders of bitcoin are resuming their sales, and continued high levels of profit realization by long-term holders means the near-term outlook for bitcoin is vulnerable." Bitfinex analysts said.

According to Monday’s Bitfinex Alpha report, the long-term holder spent output profit ratio indicates that this group, which had previously been realizing profits at prices above the last cycle’s all-time high, is now taking profits again.

"Data indicates that long-term holders, who started realizing profits at prices higher than the $69,000 previous cycle high in Q2 2024, have begun to realize profits on their spot holdings again, albeit at a lower scale now. This is despite the fact that bitcoin's price is currently trading below that peak," analysts said.

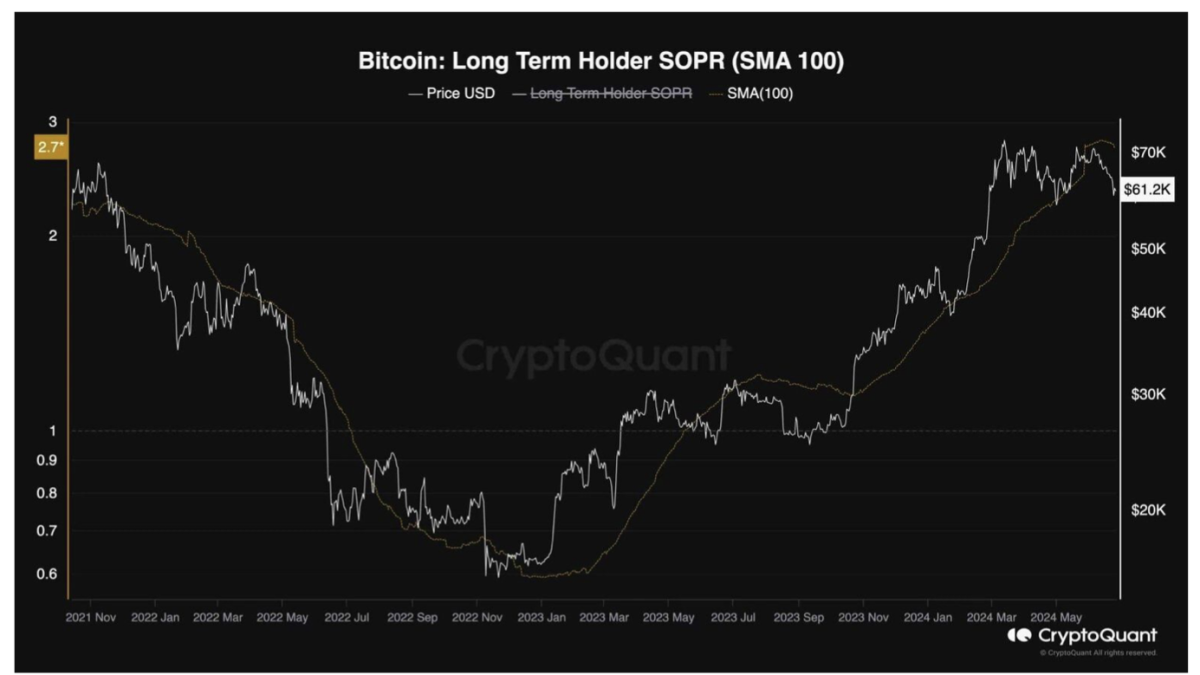

According to CryptoQuant data cited by Bitfinex analysts, the long-term holder output profit ratio is now at 2.7, marking the highest point since CryptoQuant began collecting data for this metric. According to a CryptoQuant chart, when this metric rises above the underlying price of bitcoin, it often precedes a drop in the digital asset's value.

The bitcoin long-term holder profit ratio has risen to a multi-year high. Image: CryptoQuant

The Bitfinex Alpha report added that profit realization is expected in a bull market, but that “the magnitude of this activity raises concerns.” The analysts said more long-term holder profit-taking could exert significant near-term downward pressure on bitcoin’s price, potentially extending the current decline and impacting the bull market in the mid-term.

Beyond this, bitcoin could face sell-side pressure this month due to the commencement of repayments in bitcoin and bitcoin cash to Mt. Gox creditors. More than $9.4 billion worth of recovered bitcoin is owed to approximately 127,000 creditors of Mt. Gox, who have been waiting for over 10 years to receive their funds.

RELATED INDICES

Potential downward pressure on price

According to JPMorgan analysts, these creditors are expected to sell part of their bitcoin receivables, initially putting pressure on the market, but with the potential for a recovery from August onwards.

Another point of sell-pressure could potentially arise from the German government’s recent movement of its seized bitcoin to crypto exchanges Coinbase, Bitstamp, and Kraken.

However, the Bitfinex analysts noted that support for bitcoin is being provided by a decrease in miner sell-offs and net inflows into spot bitcoin exchange-traded funds (ETFs). Spot bitcoin ETFs in the U.S. recorded a total daily net inflow of $129.45 million on Monday.

The Bitfinex report also cited increased optimism for risk assets as a whole, with the U.S. Federal Reserve’s preferred inflation measure, the Personal Consumption Expenditures Index (PCE), coming in unchanged in May, suggesting that inflation is now only slightly above the Fed’s two percent target.

The largest digital asset by market cap was changing hands at around $62,644 at the time of writing, having traded flat in the past 24 hours, according to The Block’s price page.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.